Freelancing offers unparalleled freedom, flexibility, and the exciting prospect of being your own boss. However, this independence often comes with a significant financial challenge: an unpredictable income stream. Unlike salaried employees who can reliably anticipate their bi-weekly paycheck, freelancers navigate a landscape of fluctuating project payments, client delays, and seasonal demand. This inherent volatility can make traditional budgeting feel like a futile exercise.

But fear not. With the right strategies, freelancers can not only manage their finances effectively but also build a robust financial safety net and achieve long-term stability. This comprehensive guide, akin to an Investopedia deep dive, will equip you with the knowledge and actionable steps to budget successfully on unpredictable income, transforming financial anxiety into empowerment.

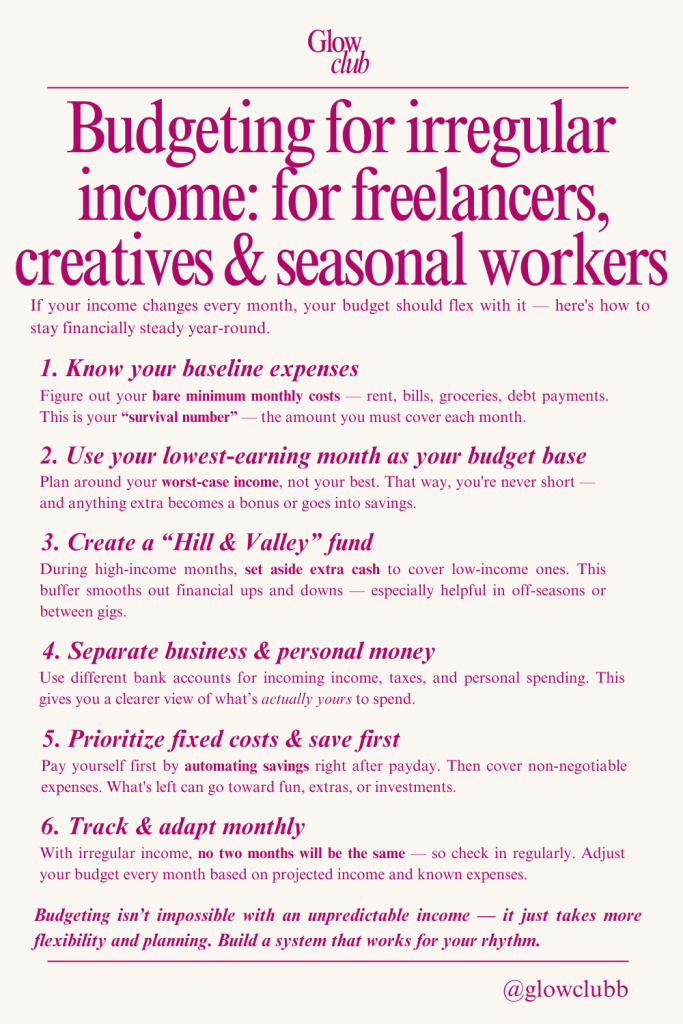

The Unique Financial Landscape of Freelancing

Before diving into solutions, it’s crucial to understand why traditional budgeting often fails for freelancers:

- Variable Income: Projects ebb and flow. One month might be booming, the next might be lean. This makes a fixed monthly budget difficult to maintain.

- Irregular Payment Schedules: Clients pay on their terms – net 30, net 60, or even upon project completion, which can be months away.

- No Employee Benefits: Freelancers are responsible for their own health insurance, retirement contributions, paid time off, and sick leave.

- Self-Employment Taxes: A significant portion of income must be set aside for federal, state, and local self-employment taxes, which aren’t automatically withheld.

- Business Expenses: Tools, software, marketing, co-working spaces – these are necessary investments that directly impact take-home pay.

These factors demand a flexible, proactive, and multi-layered approach to personal finance.

Core Principles for Freelance Budgeting Success

Successful freelance budgeting isn’t about rigid rules; it’s about building a resilient financial system. Here are the foundational principles:

- Awareness is Power: Know exactly what’s coming in and going out. This is the bedrock of any effective budget.

- Prioritize Financial Security: Before anything else, focus on building buffers against income gaps.

- Separate Business & Personal: Treat your freelance work as a legitimate business, even if you’re a solopreneur.

- Embrace Flexibility: Your budget needs to adapt to your income, not the other way around.

- Think Long-Term: Short-term fluctuations shouldn’t derail your long-term financial goals.

Actionable Strategies: How to Budget on Unpredictable Income

Here’s a detailed breakdown of strategies freelancers can implement, moving from foundational steps to more advanced techniques:

1. Track Every Penny: Income & Expenses (The Foundation)

You cannot manage what you do not measure. This is the absolute first step for any freelancer.

- Why it’s crucial: Provides a clear picture of your cash flow. You’ll identify spending patterns, understand your average monthly income, and spot areas for optimization.

- How to do it:

- Dedicated Software/Apps: Tools like Mint, YNAB (You Need A Budget), Personal Capital, or even specialized freelancer apps like QuickBooks Self-Employed or FreshBooks can automate tracking, categorize transactions, and provide visual reports.

- Spreadsheets: For the DIY enthusiast, a simple spreadsheet in Excel or Google Sheets can work wonders. Create columns for date, description, category (e.g., Groceries, Rent, Software Subscription, Client Payment), income/expense, and running balance.

- Manual Tracking: Keep receipts and log them daily or weekly. While more labor-intensive, it ensures high awareness.

- Key Insight: After 3-6 months of diligent tracking, you’ll have a much clearer idea of your average monthly income and your non-negotiable fixed expenses.

2. Determine Your "Minimum Viable Income" (MVI)

Your MVI is the absolute bare minimum you need to earn each month to cover your essential living expenses and business necessities. It’s your financial survival number.

- How to calculate:

- List all your non-negotiable personal expenses: rent/mortgage, utilities, basic groceries, transportation, minimum debt payments, health insurance.

- List all your non-negotiable business expenses: essential software subscriptions, internet, phone, crucial marketing tools.

- Sum these up. That’s your MVI.

- Purpose:

- Goal Setting: Your primary income goal for any given month should be to meet or exceed your MVI.

- Peace of Mind: Knowing this number helps you identify when you’re truly struggling versus just having a "lean" month.

- Decision Making: Helps you evaluate potential projects – does this project help me meet my MVI?

3. Build a Robust Emergency Fund (The Ultimate Buffer)

For freelancers, an emergency fund isn’t just a good idea; it’s a non-negotiable necessity. It acts as your primary buffer against income droughts, unexpected expenses, and major life events.

- How much to save: While a traditional recommendation is 3-6 months of living expenses, freelancers should aim for 6-12 months of their MVI. The higher end is advisable due to the extreme unpredictability.

- Where to keep it: In a separate, easily accessible, high-yield savings account. This keeps it distinct from your checking account and allows it to grow slightly.

- Funding strategy:

- Prioritize this fund above almost everything else until it’s fully stocked.

- Allocate a percentage of every payment you receive towards it.

- During "feast" months, direct extra income here.

4. Implement an "Income Smoothing" or "Buffer" Account

This is perhaps the most powerful tool for mental and financial stability for freelancers. The concept is to pay yourself a consistent "salary" from a separate buffer account, regardless of how much you earned that month.

- How it works:

- Estimate Your Target "Salary": Based on your MVI and a reasonable amount for discretionary spending, determine a consistent monthly personal "salary" you want to pay yourself.

- Open a Dedicated Buffer Account: This is separate from your main business checking and personal checking.

- Deposit Excess Income: When you have a "good" month and earn more than your target salary, deposit the surplus into this buffer account.

- Pay Yourself Consistently: On the same day each month (e.g., the 1st or 15th), transfer your target "salary" from your buffer account to your personal checking account.

- Draw During Lean Months: If you have a slow month, you can still pay yourself your consistent salary from the buffer, drawing down the surplus you built during busier times.

- Benefits:

- Predictable Personal Income: Eliminates the feast-or-famine stress for your personal finances.

- Better Budgeting: You can now create a more traditional personal budget based on your consistent "salary."

- Discipline: Encourages saving during peak periods.

5. Adopt a Percentage-Based Budgeting System (e.g., Profit First for Freelancers)

Traditional budgeting often starts with fixed amounts, which is tough with variable income. A percentage-based system ensures that every dollar earned is allocated to a specific purpose.

- The "Profit First" Methodology (Adapted for Freelancers): This popular system, developed by Mike Michalowicz, encourages you to allocate percentages of every single payment you receive into different bank accounts.

- Income Account: All client payments initially land here.

- Operating Expenses Account: Funds for business tools, software, marketing, etc.

- Owner’s Pay Account: This is your personal "salary" that will eventually feed your Income Smoothing account.

- Tax Account: Crucial for setting aside self-employment and income taxes.

- Profit Account: A small percentage set aside purely as profit, which can be distributed periodically or reinvested.

- Example Allocation (starting point, adjust as needed):

- Income Account: 100% of all client payments

- Transfer out:

- Owner’s Pay: 40-50% (depending on your MVI and desired lifestyle)

- Taxes: 25-35% (consult a tax professional, but always err on the higher side)

- Operating Expenses: 10-15%

- Profit: 5-10%

- Key Principle: When a payment comes in, immediately distribute it to these separate accounts. This ensures that taxes are always covered, business expenses are funded, and you’re paying yourself and building profit.

6. Separate Business and Personal Finances

This is non-negotiable for professionalism, tax purposes, and clarity.

- Dedicated Bank Accounts: Have separate checking and savings accounts for your business. All client payments go into the business checking. All business expenses are paid from it.

- Dedicated Credit Card: Use a business credit card for all business purchases. This simplifies expense tracking and keeps personal spending separate.

- Benefits:

- Tax Preparation: Makes tax time significantly easier.

- Clarity: You know exactly how much your business is earning and spending.

- Professionalism: Projects a more legitimate image to clients.

- Liability Protection: In some cases, separation can offer a layer of liability protection (especially if you’re an LLC or S-Corp).

7. Proactive Tax Planning

Self-employment taxes (Social Security and Medicare) combined with income taxes can be a significant chunk of your earnings. Ignoring them is a common and costly mistake for new freelancers.

- Set Aside a Percentage: As part of your percentage-based budgeting, immediately set aside 25-35% of every payment into a dedicated "Tax Account." This percentage can vary based on your income bracket, deductions, and state taxes.

- Pay Estimated Taxes Quarterly: The IRS requires self-employed individuals to pay estimated taxes throughout the year (typically April 15, June 15, September 15, and January 15 of the following year). Failure to do so can result in penalties.

- Track Deductions: Keep meticulous records of all eligible business expenses (home office, software, education, travel, etc.) as these reduce your taxable income.

- Consult a Tax Professional: Especially in your first few years, a CPA or tax advisor specializing in small businesses can save you money and ensure compliance.

8. Invest in Yourself and Your Business (Smartly)

While budgeting is about saving, it’s also about strategic spending that fuels growth.

- Education & Skills: Allocate funds for courses, workshops, and certifications that enhance your value proposition.

- Tools & Software: Invest in efficient tools that save you time or improve your output.

- Marketing & Branding: Budget for a professional website, portfolio, networking events, or advertising.

- Professional Development: Consider coaching or mentorship.

- Key Principle: Evaluate every business expense for its potential ROI (Return on Investment). Is it a necessary cost, or will it genuinely help you earn more or work more efficiently?

9. Regularly Review and Adjust Your Budget

Your budget isn’t a static document; it’s a living plan that needs periodic review and adjustment.

- Monthly Check-ins: Review your income, expenses, and account balances.

- Are you meeting your MVI?

- Are your percentages still appropriate?

- Are you sticking to your personal "salary"?

- Are your buffer and emergency funds growing?

- Quarterly or Annually: Conduct a deeper dive.

- Have your rates changed?

- Are your business expenses increasing or decreasing?

- Are you on track for your long-term financial goals (retirement, down payment, etc.)?

- Are there new tools or strategies you should consider?

- Be Flexible: Life happens. If a major expense arises or your income unexpectedly shifts for an extended period, don’t abandon your budget. Adjust it.

Tools and Resources for Freelance Budgeting

- Budgeting Apps:

- YNAB (You Need A Budget): Excellent for zero-based budgeting, highly recommended for variable income.

- Mint: Free, good for tracking and categorization.

- Personal Capital: Great for a holistic view of all your accounts and investments.

- Freelance-Specific Financial Tools:

- QuickBooks Self-Employed: Tracks income, expenses, mileage, and helps with estimated taxes.

- FreshBooks: Accounting software with invoicing, expense tracking, and reporting.

- Banking: Look for banks that allow you to easily open multiple sub-accounts for your different budgeting buckets (Owner’s Pay, Taxes, Buffer, etc.). Online banks often excel here.

- Financial Advisors: Consider working with a fee-only financial planner who specializes in self-employed individuals.

Common Pitfalls to Avoid

- Ignoring Taxes: This is the most common and damaging mistake. Always set aside money for taxes.

- No Emergency Fund: Leaving yourself vulnerable to the inevitable lean months.

- Lifestyle Creep: As income increases, so does spending, eroding your ability to save.

- Mixing Personal & Business Funds: Creates a bookkeeping nightmare and complicates tax filing.

- Giving Up Too Soon: Budgeting takes practice and consistency. Don’t get discouraged by initial setbacks.

- Underpricing Your Services: Not charging enough means you’re constantly struggling to meet your MVI. Factor in taxes, benefits, and business expenses when setting rates.

Conclusion: Embracing Financial Control as a Freelancer

Budgeting on unpredictable income isn’t about restriction; it’s about empowerment and strategic financial management. By implementing these detailed strategies – from meticulous tracking and building robust buffers to adopting percentage-based allocations and proactive tax planning – freelancers can transform financial uncertainty into a foundation of stability and growth.

Embrace the freedom of freelancing without sacrificing your financial future. Start today by tracking your income and expenses, calculating your MVI, and setting up your first emergency fund. The journey to financial mastery as a freelancer begins with these deliberate, informed steps.