The arrival of a new baby is an occasion brimming with unparalleled joy, excitement, and anticipation. Yet, amidst the flurry of nursery preparations and choosing tiny outfits, a common concern quietly emerges for many parents-to-be: the financial implications. In the United Kingdom, the cost of raising a child can be substantial, from initial setup expenses to long-term childcare and education. However, with careful planning, smart strategies, and an understanding of available support, it is entirely possible to welcome your little one without compromising your financial stability.

This comprehensive guide, inspired by the detailed approach of Investopedia, will walk you through the essential steps of budgeting for a baby in the U.K., empowering you to make informed financial decisions and embrace parenthood with confidence.

The Financial Realities of Parenthood in the UK

Before diving into the "how," it’s crucial to acknowledge the "what." The financial landscape of bringing up a child in the UK can be daunting if not approached strategically. According to various reports, the cost of raising a child from birth to age 18 can run into hundreds of thousands of pounds, excluding university fees. While this figure encompasses a broad spectrum of expenses over nearly two decades, the immediate costs associated with a newborn are what typically cause the most anxiety.

Key Cost Categories to Anticipate:

- One-off / Initial Setup Costs: Pram, cot, car seat, nursery furniture, clothing haul.

- Ongoing Monthly Costs: Nappies, wipes, formula (if applicable), baby food, clothing replacements, toiletries, toys.

- Future Costs: Childcare, school expenses, extracurricular activities, healthcare (beyond NHS basics), pocket money.

- Indirect Costs: Reduced income due to maternity/paternity leave, potential career breaks, increased utility bills.

Understanding these categories is the first step towards building a robust baby budget.

Phase 1: Pre-Baby Financial Foundations – Setting the Stage for Success

The months leading up to your baby’s arrival are prime time for financial preparation. This phase focuses on understanding your current financial standing, anticipating income changes, and building a solid savings buffer.

1. Understanding Income Changes: Maternity, Paternity & Parental Leave

One of the most significant financial shifts for new parents is the change in income during parental leave. The UK offers several statutory provisions, but they often represent a reduction from regular earnings.

- Statutory Maternity Pay (SMP):

- Eligibility: Must have worked for your employer for at least 26 weeks into the 15th week before the expected week of childbirth (EWC) and earn at least £123 per week (before tax).

- Payment: 90% of your average weekly earnings (before tax) for the first 6 weeks, then £172.48 per week or 90% of your average weekly earnings (whichever is lower) for the next 33 weeks.

- Duration: Up to 39 weeks.

- Statutory Paternity Pay (SPP):

- Eligibility: Similar service and earnings criteria to SMP.

- Payment: £172.48 per week or 90% of your average weekly earnings (whichever is lower).

- Duration: 1 or 2 consecutive weeks.

- Shared Parental Leave (ShPL) & Pay (ShPP):

- Allows parents to share up to 50 weeks of leave and 37 weeks of pay. This can offer more flexibility but requires careful planning between parents and employers.

- Payment: £172.48 per week or 90% of your average weekly earnings (whichever is lower).

Actionable Steps:

- Check your employer’s policy: Many companies offer enhanced maternity/paternity pay, which can significantly boost your income during leave.

- Calculate your projected income: Use the statutory figures or your employer’s enhanced pay to estimate your income during your leave period.

- Identify the income gap: Compare your current monthly income with your projected leave income. This "gap" is what you need to cover through savings or budget adjustments.

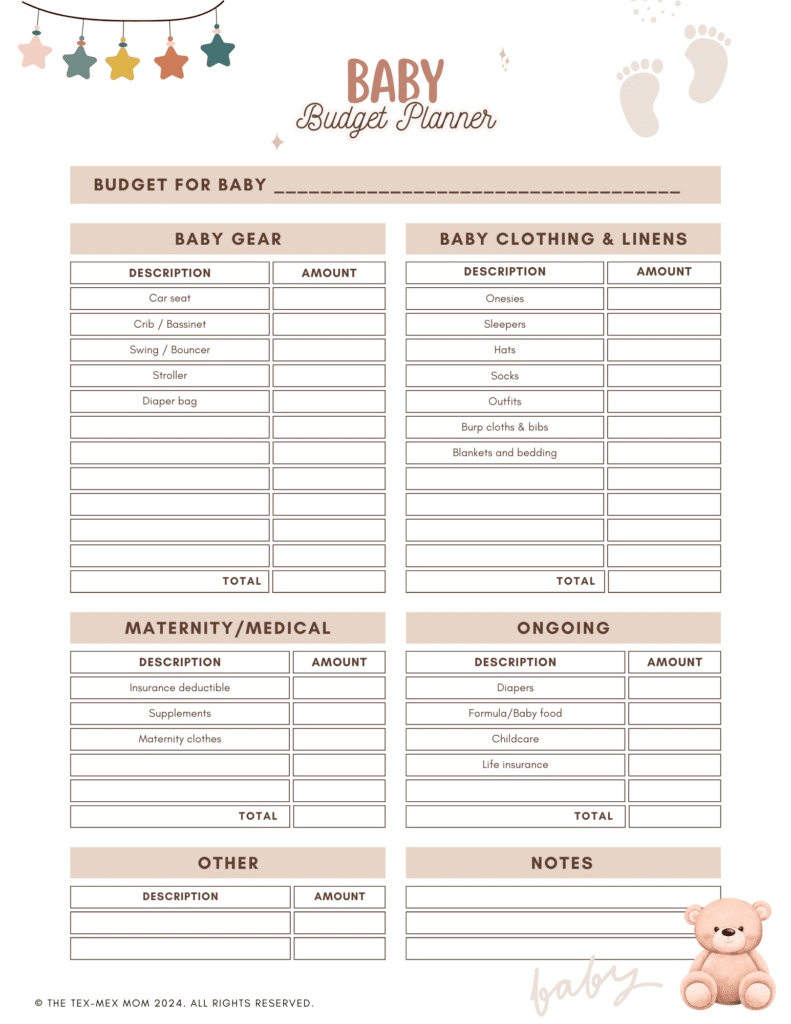

2. Building a Baby Budget: Your Financial Blueprint

A detailed budget is your roadmap to financial control. Think of it as a living document that will evolve as your baby grows.

- Step 1: Audit Your Current Spending:

- Before you can allocate funds for a baby, you need to know where your money is currently going.

- Method: Track every penny for at least 1-3 months. Use banking apps, spreadsheets, or budgeting tools like Mint, YNAB, or your bank’s budgeting features.

- Identify: Fixed costs (rent/mortgage, utilities, loan repayments) and variable costs (groceries, entertainment, dining out).

- Step 2: Estimate Baby Expenses:

- Research typical costs for essential baby items. Online calculators (e.g., from MoneyHelper, NCT) can provide a good starting point.

- Categorise:

- One-Off: Cot, pram, car seat, changing table, high chair, baby monitor.

- Monthly Consumables: Nappies (approx. £30-£60/month), wipes (£10-£20/month), formula (£40-£80+/month if not breastfeeding), baby food (£20-£40/month during weaning).

- Clothing: Initial haul (can be significant), then ongoing replacements.

- Healthcare/Insurance: While NHS provides free care, consider private health insurance or income protection.

- Step 3: Factor in Income Changes & Create a "New Normal" Budget:

- Integrate your estimated baby expenses and your reduced leave income into your existing budget.

- Prioritise: Distinguish between "needs" (e.g., nappies, food) and "wants" (e.g., designer baby clothes, numerous toys).

- Scenario Planning: Create budgets for different scenarios – e.g., if you breastfeed exclusively vs. formula feeding, if you get a great deal on a pram vs. buying new.

- Step 4: Establish a Savings Plan:

- Emergency Fund: Aim for 3-6 months of essential living expenses (including baby costs) to cover unexpected events.

- Baby Fund: Set a specific savings goal for large one-off purchases (pram, cot) and to bridge the income gap during parental leave.

- Automation: Set up automatic transfers from your current account to your savings account on payday.

Phase 2: Navigating Essential Baby Expenses & Smart Savings Strategies

Once your financial foundations are set, the next step is to tackle the specific expense categories with a savvy, cost-effective approach.

1. Nursery & Gear: Smart Shopping for Big-Ticket Items

The nursery can be a money pit if you’re not careful. Focus on essentials and look for value.

- Must-Haves vs. Nice-to-Haves:

- Must-Haves: Safe sleeping space (cot/crib/bassinet), car seat (new for safety reasons), pram/stroller, changing mat, baby carrier.

- Nice-to-Haves: Elaborate nursery decor, specific baby gadgetry, bottle steriliser (unless formula feeding), baby food maker (blender works fine).

- Second-Hand Savings:

- Where to Look: NCT Nearly New Sales, Gumtree, Facebook Marketplace, eBay, Freecycle, local charity shops.

- What to Buy Used: Cots (check safety standards, buy a new mattress), changing tables, baby clothes, baby bouncers, playmats, toys, high chairs.

- What to Buy New (for Safety): Car seats (due to potential invisible damage from accidents), mattresses for cots (for hygiene and SIDS prevention).

- Borrowing & Gifting: Don’t be shy about accepting hand-me-downs from friends and family. Many new parents receive gifts of clothes and toys, reducing your initial outlay.

- Bulk Buying & Sales: Keep an eye out for baby event sales at major retailers (e.g., John Lewis, Mamas & Papas, Boots, Mothercare when it existed).

2. Diapers: Reusable, Disposable, or a Mix?

Diapers are a significant ongoing cost. Consider your options carefully.

- Disposable Diapers:

- Cost-Saving: Buy in bulk from supermarkets or online retailers (Amazon Subscribe & Save often offers discounts). Look for loyalty schemes and coupons.

- Brand Loyalty: Don’t be afraid to try supermarket own-brands; they often perform just as well as premium brands at a fraction of the cost.

- Reusable Cloth Diapers:

- Initial Investment: Can be substantial (£200-£500 for a full set).

- Long-Term Savings: Significantly cheaper over time as you only pay for washing. Better for the environment.

- Trial Packs: Some councils offer trial packs or discounts on reusable nappies.

- Wipes: Consider reusable wipes (flannels and water) or buying disposable wipes in bulk.

3. Feeding: Breast vs. Formula & Weaning Wisely

Feeding is another major expense category with significant variations.

- Breastfeeding:

- Cost-Effective: Potentially free, but involves time commitment and may require accessories (nursing bras, pump, milk storage bags).

- Support: NHS, La Leche League, NCT offer free breastfeeding support.

- Formula Feeding:

- Cost: A significant ongoing expense, typically £40-£80+ per month, depending on the brand and baby’s consumption.

- No Discounts: By law, formula cannot be discounted or promoted, so don’t expect sales.

- Bulk Buying: Can buy larger tubs, but ensure you use them before expiry.

- Weaning:

- Homemade Baby Food: Far cheaper than pre-made pouches and jars. A basic blender and ice cube trays for freezing portions are all you need.

- Family Meals: Adapt your family meals to be baby-friendly (e.g., less salt, suitable textures).

4. Clothing: From Hand-Me-Downs to Sales Racks

Babies grow incredibly fast, meaning they’ll outgrow clothes in weeks, not months.

- Hand-Me-Downs: Embrace them! Babies don’t wear clothes long enough to wear them out.

- Sales & Bundles: Buy ahead in sales for the next size up. Look for clothing bundles on second-hand sites.

- Essentials Only: Focus on practical items like sleepsuits, vests, and basic outfits. You don’t need dozens of elaborate dresses or tiny suits.

- Gifts: Many friends and family will buy clothes as gifts. Factor this into your initial shopping.

5. Healthcare: Leveraging the NHS & Smart Choices

The UK’s National Health Service (NHS) provides comprehensive, free-at-point-of-use healthcare for children.

- GP & Health Visitor Services: All routine check-ups, vaccinations, and general medical care are covered.

- Prescriptions: Children under 16 (and their parents for baby-specific items) are usually exempt from prescription charges.

- Dental Care: Children’s dental care is also free on the NHS.

- First Aid Kit: Essential to have on hand for minor scrapes and illnesses.

6. Childcare: The UK’s Biggest Expense for Working Parents

Childcare costs in the UK are among the highest in the world and are often the most significant ongoing expense for working parents.

- Average Costs: Full-time nursery care for a child under two can cost £1,000-£1,500+ per month in many areas.

- Government Support Schemes:

- 15/30 Free Hours:

- 15 hours: All 3- and 4-year-olds in England are entitled to 15 hours of free early education per week for 38 weeks of the year. Some 2-year-olds also qualify based on specific criteria.

- 30 hours: Working parents of 3- and 4-year-olds may be eligible for an additional 15 hours, totalling 30 free hours. Income thresholds apply.

- Upcoming Changes: From April 2024, the 15/30 hours scheme is being extended to younger children. Parents of 2-year-olds will get 15 hours from April 2024, then all children from 9 months will get 15 hours from September 2024, expanding to 30 hours from September 2025. Stay updated on eligibility and application dates.

- Tax-Free Childcare:

- Eligibility: Working parents (or one parent if the other is incapacitated) can get up to £500 every 3 months (£2,000 a year) for each child to help with the cost of childcare. The government adds 20p for every 80p you pay in, up to £2,000 per child per year.

- Income Thresholds: Both parents must earn at least the National Minimum Wage for 16 hours a week, and neither can earn over £100,000 per year.

- Universal Credit for Childcare:

- If you receive Universal Credit, you may be able to claim back up to 85% of your childcare costs, up to a maximum of £951.00 for one child or £1,630.00 for two or more children per month.

- Note: You cannot usually claim Tax-Free Childcare and Universal Credit for childcare at the same time. You need to assess which scheme offers you more support.

- 15/30 Free Hours:

Actionable Steps:

- Research early: Childcare places fill up quickly. Start looking at nurseries, childminders, and nannies well before you need them.

- Understand eligibility: Use the government’s childcare calculator to see what support you qualify for.

- Consider alternatives: Grandparent care, shared nannies, or flexible working arrangements can significantly reduce costs.

7. Miscellaneous Costs & Entertainment

Don’t forget the ‘little’ things that add up.

- Toys: Babies don’t need many toys initially. Simple rattles, soft toys, and sensory items are sufficient. Borrow from friends, use library toy schemes, or buy second-hand.

- Classes: Baby sensory, music classes, swimming lessons – these can be great for development and socialisation but can be expensive. Prioritise one or two, or look for free local groups.

- Gifts: Budget for birthday and Christmas gifts for your child as they grow.

- Emergency Fund: Reiterate the importance of a dedicated emergency fund for unexpected costs (e.g., a broken pram, urgent doctor’s visit, unforeseen travel).

Phase 3: Long-Term Financial Planning for Your Growing Family

Budgeting for a baby isn’t just about the first year; it’s about setting up long-term financial security for your family.

1. Savings & Investments for the Future

- Junior ISAs (JISAs): A tax-efficient way to save for your child’s future. Up to £9,000 can be invested annually, growing tax-free until the child turns 18, when they gain access.

- Premium Bonds: An alternative savings option where you don’t earn interest but are entered into a monthly prize draw with tax-free winnings.

- General Investment Account: If you’ve maximised other tax-efficient options, a general investment account can be used, though gains are subject to Capital Gains Tax.

- Starting Early: Even small, regular contributions can grow significantly over 18 years due to compound interest.

2. Insurance: Protecting Your Family’s Future

- Life Insurance: Essential for parents. Ensures your family is financially secure if you or your partner passes away.

- Income Protection Insurance: Provides a regular income if you’re unable to work due to illness or injury.

- Critical Illness Cover: Pays out a lump sum if you’re diagnosed with a specified critical illness.

3. Wills: Ensuring Your Child’s Guardianship and Inheritance

- Legal Guardianship: A will allows you to appoint legal guardians for your children should both parents pass away. Without one, the courts decide.

- Inheritance: Dictates how your assets are distributed, ensuring your children are provided for according to your wishes.

Leveraging UK Government Support & Benefits

Beyond childcare, the UK government offers several other benefits to support families.

- Child Benefit:

- Payment: £24.00 per week for your eldest or only child and £15.90 per week for each additional child (as of 2023/24).

- Who Claims: Usually claimed by one parent.

- High Income Child Benefit Charge (HICBC): If either parent earns over £50,000, some or all of the Child Benefit may need to be paid back through a tax charge. If either earns over £60,000, it’s fully repaid. Even if you don’t receive the payment due to HICBC, it’s often advisable to claim so your child receives National Insurance credits, which can count towards their future State Pension.

- Healthy Start Scheme:

- Vouchers: Provides vouchers or a pre-paid card to buy milk, fruit, vegetables, and infant formula milk.

- Eligibility: Low-income families who are pregnant or have a child under 4 and receive certain benefits.

- Sure Start Maternity Grant:

- One-off Payment: A £500 grant to help with the costs of having a new baby.

- Eligibility: Usually for your first child, if you or your partner receive certain benefits. You must claim within 11 weeks of the baby’s due date or within 6 months after the birth.

Mindset & Sustainable Parenthood: Beyond the Numbers

While numbers are important, your approach to spending and expectations as a parent can be just as impactful.

- Frugality is a Journey, Not a Race: Don’t feel pressured to buy everything new or instantly. Take your time, hunt for deals, and accept help.

- Prioritise Experiences Over Things: Babies thrive on interaction, love, and stimulation, not endless expensive toys.

- Don’t Compare: Social media and advertising often portray an idealised, expensive version of parenthood. Focus on what works for your family and your budget.

- Community Support: Join local parent groups. They are a fantastic source of free advice, hand-me-downs, and emotional support.

- Flexibility is Key: Parenthood is unpredictable. Your budget needs to be adaptable. There will be unexpected costs and times when you need to adjust your spending.

Conclusion: Empowering Your Parenthood Journey

Budgeting for a baby in the U.K. without going broke is not just achievable; it’s an empowering process that lays a strong financial foundation for your family’s future. By understanding the costs, leveraging government support, embracing smart savings strategies, and focusing on what truly matters, you can navigate the financial aspects of parenthood with confidence and joy. Welcome your little one into a secure and loving home, knowing you’ve planned thoughtfully for their well-being.

Disclaimer: This article provides general financial guidance and information. It is not intended as personal financial advice. Specific circumstances vary, and it is recommended to consult with a qualified financial advisor for personalised advice regarding your individual situation. Tax laws and benefit entitlements can change, so always refer to official government sources (e.g., Gov.uk, MoneyHelper) for the most current information.