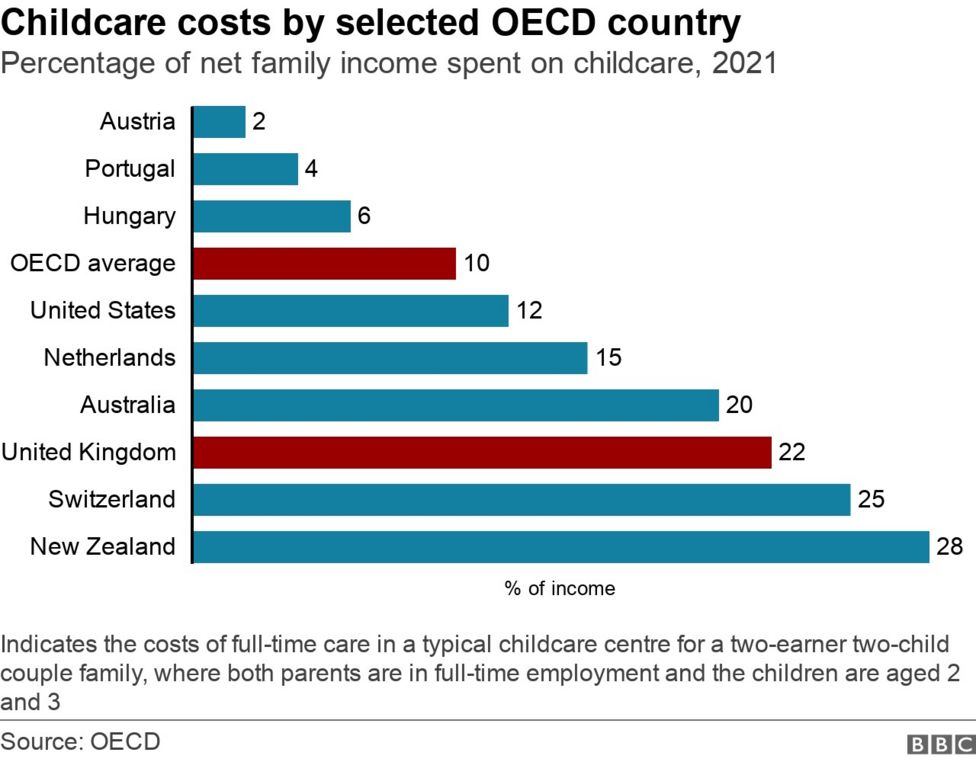

The cost of childcare is a significant financial burden for many Australian families, often rivaling or even exceeding mortgage repayments or rent. With quality early learning and care being essential for children’s development and parents’ ability to work, finding ways to make it more affordable is a top priority.

This comprehensive guide, inspired by the detailed approach of Investopedia, will break down actionable strategies and little-known tips that Australian families can leverage to potentially cut their childcare costs in half. We’ll delve into government subsidies, smart provider choices, alternative care models, and financial planning to help you navigate the system and save thousands.

The Australian Childcare Cost Landscape: Why It’s So Expensive

Before diving into solutions, it’s important to understand why childcare in Australia is so expensive. Factors contributing to the high costs include:

- High Staff-to-Child Ratios: Australian regulations mandate specific staff-to-child ratios to ensure safety and quality, particularly for younger children. This drives up labour costs.

- Qualified Educators: A significant portion of childcare staff must hold specific qualifications, commanding higher wages.

- Operating Costs: Rent, utilities, insurance, educational resources, food, and administrative overhead all contribute.

- Demand: In many urban areas, demand for childcare places outstrips supply, allowing providers to charge premium rates.

- Government Regulations: While designed for quality, compliance with extensive regulations adds to operational expenses.

Despite these factors, strategic planning and informed decisions can significantly reduce your out-of-pocket expenses.

Strategy 1: Maximising the Child Care Subsidy (CCS) – Your Biggest Lever

The Child Care Subsidy (CCS) is the Australian Government’s primary mechanism to help families with the cost of approved childcare. For most families, understanding and optimising their CCS is the single most effective way to cut costs.

What is the CCS?

The CCS is a payment made directly to your approved childcare provider to reduce the fees you pay. It’s not a cash payment to you. The amount you receive depends on three factors:

- Your Family’s Combined Income: This determines the percentage of your fees the government will subsidise.

- The Activity Level of Both Parents: This determines the number of subsidised hours you’re eligible for.

- The Type of Care You Use: There are hourly rate caps for different types of approved care.

Key Steps to Maximise Your CCS:

- 1. Understand the Activity Test Inside Out: This is where many families leave money on the table. Both parents (or the sole parent) must meet an activity test to be eligible for CCS, unless an exemption applies.

- What Counts as "Activity"?

- Paid work (including leave, self-employment, casual work)

- Study and training

- Volunteering

- Looking for work

- Unpaid work in a family business

- Parental leave (if you have another child in care)

- Participating in an approved program of activity

- Maximising Your Hours: The more hours of recognised activity you (and your partner) undertake, the more subsidised hours you receive, up to a maximum of 100 hours per fortnight.

- Example: If one parent works full-time (40 hours/week) and the other works 20 hours/week, their combined activity level will likely qualify them for the highest number of subsidised hours. Even if you only need 3 days of care, ensure your activity level supports maximum hours, as circumstances can change.

- Underestimated Activity: Don’t forget travel time to/from work/study, lunch breaks, and even passive job searching (e.g., regularly updating your resume, applying for jobs online). Keep a record!

- Volunteer Work: If one parent is not working, even a few hours of regular volunteer work can significantly increase your CCS eligibility. This is a powerful tool for stay-at-home parents looking to access more subsidised care.

- What Counts as "Activity"?

- 2. Keep Your Income Estimates Accurate: Your CCS percentage is based on your estimated annual family income.

- Underestimate Slightly: If you consistently overestimate your income, you might receive less CCS than you’re entitled to during the year. If you underestimate slightly, you’ll receive more during the year, and Centrelink will reconcile it at tax time. A small debt can be managed, but missing out on upfront savings hurts cash flow.

- Update Immediately: If your income changes significantly (e.g., a promotion, job loss, parental leave), update your estimate on MyGov straight away. This prevents overpayments or underpayments.

- 3. Understand the Hourly Rate Caps: The government sets hourly rate caps for different types of care. If your provider charges more than the cap, you pay the difference before your CCS percentage is applied.

- Research Provider Fees: Compare hourly rates of local providers against the current CCS hourly cap for your care type. Choosing a provider whose fees are at or below the cap can make a huge difference.

- Example: If the cap is $12.74/hour for centre-based care and your provider charges $13.50/hour, you pay the extra $0.76/hour out of pocket before your CCS is calculated on the $12.74.

- 4. The Annual Cap: For higher-income families, there used to be an annual CCS cap. As of July 10, 2023, the annual CCS cap has been removed. This is a massive win for families with higher incomes using extensive childcare, as they are no longer limited in the total amount of subsidy they can receive per financial year.

- 5. Additional Child Care Subsidy (ACCS): Families facing challenging circumstances (e.g., at risk of homelessness, experiencing domestic violence, grandparents caring for grandchildren) may be eligible for ACCS, which provides a higher level of subsidy, often covering 100% of fees up to the hourly rate cap. Check eligibility if you are in these situations.

Strategy 2: Smart Choices in Childcare Providers

Beyond CCS, your choice of provider and care model significantly impacts costs.

-

1. Compare Different Types of Approved Care:

- Long Day Care (LDC): Often the most expensive, but provides full-day care, structured programs, and meals. Costs vary widely.

- Family Day Care (FDC): Care provided in an educator’s home. Often more flexible hours and a lower educator-to-child ratio. Can be significantly cheaper than LDC, especially for infants.

- Before & After School Care (OSHC): For school-aged children. Generally lower daily/session rates than LDC.

- In-Home Care: For specific circumstances (e.g., children with disability, families in remote areas, shift workers). CCS applies to approved services. Generally more expensive than LDC or FDC, but may be essential.

- Consider a Hybrid Approach: Could you use FDC for younger children, then transition to LDC when they’re older and costs are relatively lower (due to better ratios)?

-

2. Location, Location, Location:

- Urban vs. Regional: Childcare in major metropolitan areas, especially inner-city suburbs, is typically more expensive due to higher overheads (rent, staff wages).

- Commuter Route: Look for centres slightly off the main commuter route or in less affluent suburbs, which may offer better value.

- Work vs. Home: Compare options near your workplace versus near your home. Sometimes, a centre further from the CBD but closer to a partner’s workplace or a less expensive suburb can save hundreds per month.

-

3. Scrutinise Fee Structures:

- Daily vs. Hourly Rates: Some centres charge a flat daily rate regardless of actual attendance hours. If you only need shorter days (e.g., 8 hours), a centre with an hourly rate or sessional booking might be cheaper, even if the hourly rate seems slightly higher.

- Included Extras: Does the fee include meals, nappies, sunscreen, excursions? Or are these additional costs? Factor these into your comparison.

- Enrolment Fees/Bond: Factor in upfront costs. Some centres waive or reduce enrolment fees during promotions.

- Public Holidays: Many centres charge for public holidays if your child’s booked day falls on one. This can add up. Ask about their policy.

- Sick Days/Absences: CCS typically covers up to 42 absence days per financial year without requiring proof. After that, you may need to provide medical certificates to continue receiving CCS for absences.

-

4. Don’t Be Afraid to Negotiate (Within Reason):

- While you can’t typically haggle over daily rates at large centres, you might be able to negotiate on enrolment fees, bond payments, or ask about any sibling discounts they offer (even if not advertised).

- For smaller, independent centres or family day care providers, there might be slightly more flexibility, especially if they have vacancies.

Strategy 3: Optimising Your Childcare Usage

You pay for the hours you book, not necessarily the hours you use. Be strategic.

-

1. Only Book the Days/Hours You Absolutely Need:

- Part-Time vs. Full-Time: If you can manage with 2, 3, or 4 days a week, do so. Many parents feel pressure to enrol full-time, but cutting even one day can save hundreds per month.

- Sessional Bookings: Some centres offer shorter sessions (e.g., 9 am – 3 pm or 7 am – 1 pm) which are cheaper than a full day. If your work schedule allows, this is a great cost-saver.

- Utilise Half-Days: If a centre allows it and your CCS covers it, a half-day might be perfect for errands or a short work block.

-

2. Coordinate with Your Partner’s Schedule:

- Can one parent drop off later and the other pick up earlier? This might allow you to book fewer "full days" or take advantage of shorter sessions.

- Consider staggered workdays where one parent works Monday-Thursday and the other Tuesday-Friday, potentially reducing the number of days a child is in care.

-

3. Take Advantage of "Kindy/Preschool" Programs:

- Many Long Day Care centres offer a "Kindergarten Program" for the year before school. In some states (like Victoria and NSW), there are now significant subsidies or free hours available for these programs, even if they are run within a LDC centre. Research what’s available in your state for 3 and 4-year-old kinder. This can drastically reduce the cost of that crucial pre-school year.

Strategy 4: Exploring Alternative & Hybrid Care Models

Beyond traditional centres, other options can significantly reduce costs.

-

1. Nanny Share:

- How it works: Two or more families share the cost of one nanny, who cares for all children, usually rotating between homes.

- Cost Savings: While a sole nanny is expensive, sharing the cost can make it comparable to or even cheaper than LDC for two or more children, especially for infants.

- Benefits: In-home care, flexibility, individual attention, less exposure to illness.

- CCS Eligibility: Generally, nannies are not CCS-approved unless they are part of an approved In-Home Care service. This means the full cost comes out of pocket, so compare this against your post-CCS centre costs. It can still be cheaper for multiple children.

-

2. Au Pair:

- How it works: A young person (often from overseas) lives with your family, provides childcare and light housework in exchange for room, board, and a small weekly stipend (pocket money).

- Cost Savings: The cash outlay is significantly lower than a nanny, as the main cost is providing accommodation and food.

- Considerations: Cultural exchange, requires an extra room, may not have formal childcare qualifications, limited hours. Not CCS-eligible.

-

3. Grandparent/Family Care:

- The Ultimate Cost Saver: If you have willing and capable family members nearby, this is often the most financially beneficial option.

- Formalising Arrangements: Consider a small payment to cover their expenses or as a thank you. Clearly define expectations regarding hours, activities, and routines to avoid misunderstandings.

- CCS and Grandparents: If a grandparent is an approved Family Day Care educator, then CCS can apply. However, for informal care, CCS does not apply.

-

4. Parent Cooperatives/Swaps:

- How it works: A group of parents take turns caring for each other’s children.

- Cost Savings: Can be virtually free, or very low cost if there are shared resources (e.g., a rented space for a few hours a week).

- Considerations: Requires a high level of trust, organisation, and commitment from all participating parents. Not CCS-eligible.

-

5. Utilise Local Playgroups and Community Resources:

- Many councils and community centres run free or low-cost playgroups, toy libraries, and occasional care programs. While not full-time childcare, they can provide a few hours of supervised play, giving parents a break or time to work, and are a great way to socialise children.

Strategy 5: Financial Planning & Budgeting for Childcare

Even with subsidies and smart choices, childcare remains a significant expense. Integrating it into your overall financial plan is crucial.

-

1. Create a Dedicated Childcare Budget:

- Track Everything: Understand your exact out-of-pocket costs after CCS. Include any extra fees, late pick-up charges, or occasional care.

- Allocate Funds: Treat childcare as a non-negotiable expense, just like your mortgage. Set aside funds specifically for it.

- Review Regularly: Childcare costs can change with age, and your CCS percentage might be adjusted. Review your budget quarterly.

-

2. Build an Emergency Fund:

- Having a buffer can help with unexpected childcare costs (e.g., if you lose CCS eligibility temporarily, or need extra days).

-

3. Salary Sacrifice (Limited Application):

- While rare for standard childcare, some employers might offer salary sacrifice options for specific types of in-home care or for specific employer-provided childcare facilities. It’s worth asking your HR department, but don’t expect it for typical LDC.

-

4. Maximise Other Savings:

- Look for other areas in your budget where you can cut back to offset childcare costs. Every dollar saved elsewhere helps reduce the overall financial strain.

Key Considerations for All Strategies

- Quality is Paramount: Never compromise on the safety, care, and educational quality for your child to save money. Visit centres, read reviews, and trust your gut feeling. A poor quality environment can have long-term negative impacts.

- Waiting Lists: Quality, affordable childcare places often have long waiting lists. Start researching and putting your name down as early as possible – ideally during pregnancy or as soon as you know your needs.

- Flexibility: Life happens. Look for providers who offer some flexibility in bookings or whose policies are reasonable regarding absences or changes.

- Communication is Key: Maintain open communication with your childcare provider and Centrelink/Services Australia regarding your circumstances and any changes.

- Review Annually: Your income, activity levels, and the cost of childcare change over time. Make it a habit to review your CCS details and childcare arrangements at least once a year, ideally before the new financial year.

Conclusion: Empowering Your Family’s Financial Future

Cutting childcare costs in half might seem like an ambitious goal, but with a strategic approach and a thorough understanding of the available options, it is entirely achievable for many Australian families. By diligently maximising your Child Care Subsidy, making informed choices about your care provider, optimising your usage, and exploring alternative models, you can significantly reduce one of your household’s largest expenses.

Empowered with this knowledge, you are better equipped to make decisions that not only support your child’s development but also bolster your family’s financial well-being. Start exploring these options today and take control of your childcare expenditure.

Disclaimer: This article provides general information and guidance only. Child Care Subsidy rules and eligibility criteria can change. Always refer to the official Services Australia (Centrelink) website or consult with a qualified financial advisor for personalised advice relevant to your specific circumstances.