The back-to-school season, while exciting, often brings with it a significant financial burden for families. From textbooks and technology to clothing and extracurricular fees, the costs can quickly escalate, leaving parents feeling overwhelmed. As we look ahead to 2025, proactive financial planning becomes not just beneficial, but essential.

This comprehensive guide, designed with the detailed and actionable insights akin to Investopedia, will equip you with 15 intelligent budgeting hacks to navigate the back-to-school rush in 2025 without breaking the bank. By implementing these strategies, you can significantly reduce your expenditures, alleviate financial stress, and ensure your children are well-prepared for a successful academic year.

The Rising Cost of Education: Why Proactive Budgeting Matters

Before diving into the hacks, it’s crucial to understand the landscape. The cost of K-12 education supplies and apparel has steadily climbed over the past decade, influenced by inflation, evolving technological requirements (laptops, tablets), and changing fashion trends. Industry reports often cite average spending per child in the hundreds of dollars, which can quickly multiply for families with multiple children.

Why is a dedicated back-to-school budget so important?

- Avoid Impulse Purchases: Without a plan, it’s easy to succumb to marketing ploys and buy items that aren’t truly necessary.

- Prevent Financial Strain: Unexpected large expenses can derail household budgets, leading to credit card debt or dipping into savings.

- Optimize Savings Opportunities: Strategic budgeting allows you to capitalize on sales, discounts, and tax-free holidays.

- Teach Financial Literacy: Involving children in the budgeting process can be a powerful lesson in financial responsibility and decision-making.

- Reduce Stress: Knowing you have a plan in place and sticking to it can significantly lower the anxiety associated with back-to-school shopping.

By adopting a forward-thinking approach for 2025, you transform a potential financial headache into an opportunity for smart saving and financial education.

The 15 Hacks to Save Big on Back-to-School in 2025

Here are 15 detailed strategies to help you master your back-to-school budget for the upcoming academic year:

1. Start Early and Plan Ahead (January-June 2025)

- Detailed Content: Procrastination is the enemy of savings. Begin thinking about back-to-school needs as early as January or February. This isn’t about buying then, but about observation and preliminary planning. Monitor sales cycles throughout the year. Many retailers start clearing out inventory in spring and early summer, offering discounts on items like backpacks, lunchboxes, and even some apparel. Early planning also allows you to spread out purchases over several months, easing the immediate financial burden in July/August.

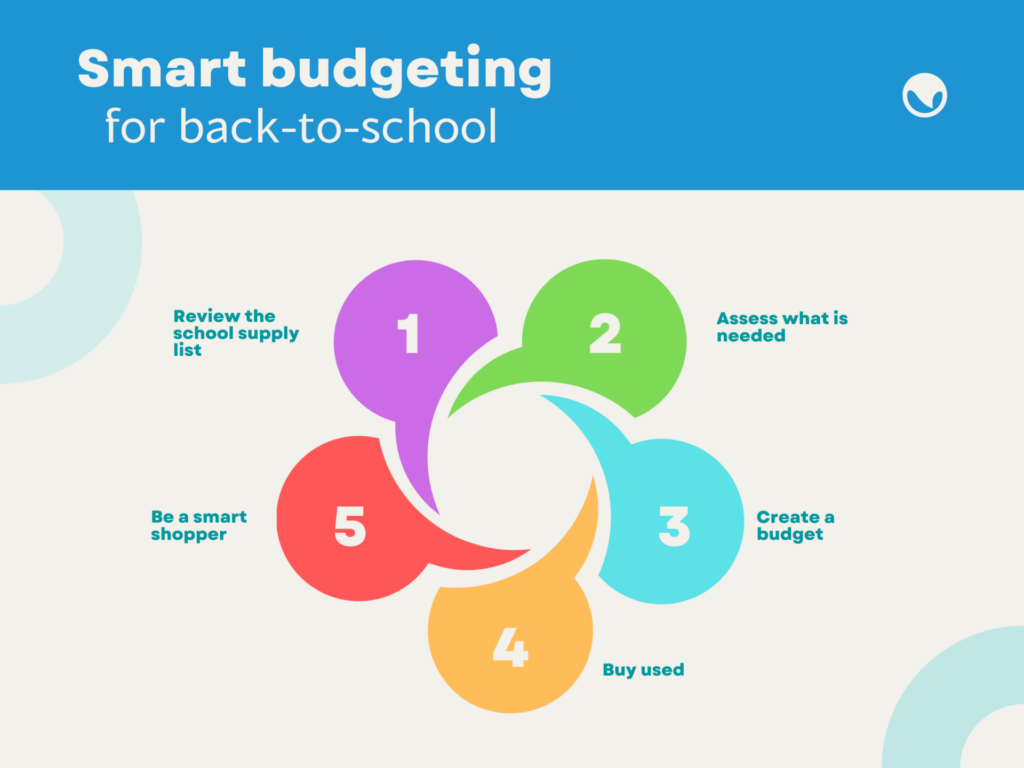

2. Conduct a Thorough Inventory of Existing Supplies

- Detailed Content: Before buying anything new, perform a meticulous inventory of what you already have. Go through backpacks, desk drawers, and closets. You might be surprised to find unused notebooks, partially used pens, rulers, calculators, or even clothes that still fit or can be repurposed. Categorize items: "definitely needed," "usable," "needs replacement," "optional." This step is crucial for creating an accurate shopping list and avoiding duplicate purchases.

3. Create a Detailed, Categorized Shopping List

- Detailed Content: Once your inventory is complete, develop a comprehensive shopping list. Break it down into categories:

- School Supplies: Pencils, pens, notebooks, binders, art supplies, calculators.

- Clothing/Footwear: Uniforms (if applicable), everyday wear, athletic shoes, winter coats.

- Technology: Laptops, tablets, headphones, software (check school requirements).

- Lunch Supplies: Lunchboxes, water bottles, thermos.

- Miscellaneous: Backpacks, locker organizers, desk supplies for home.

- Needs vs. Wants: Clearly differentiate between essential items required by the school and optional items your child wants. Prioritize needs first.

4. Establish a Firm Budget and Stick to It

- Detailed Content: Based on your shopping list and an understanding of average costs, set a realistic total budget. Then, allocate specific amounts to each category (e.g., $100 for supplies, $200 for clothing). Involve your children in this process, especially older ones. Explain the budget limits and let them make choices within those parameters. This fosters financial responsibility and helps them understand the value of money. Use a spreadsheet or a budgeting app to track spending in real-time.

5. Strategically Shop Back-to-School Sales (July-August)

- Detailed Content: Retailers typically launch their major back-to-school sales in late July and early August. Don’t buy everything at the first sale. Instead, track prices across different stores (online and brick-and-mortar) using flyers, apps, and price comparison websites. Look for "loss leader" items – deeply discounted basic supplies that stores use to attract customers. Stock up on these non-perishable basics (pencils, glue sticks, paper) when they hit their absolute lowest prices.

6. Utilize Price Comparison Tools and Apps

- Detailed Content: In the digital age, comparing prices is easier than ever. Leverage online tools like Google Shopping, CamelCamelCamel (for Amazon price history), and store-specific apps. Many retailers offer price-matching policies; be prepared to show competitors’ ads to take advantage of these. Consider browser extensions that automatically check for coupons and better prices when you’re shopping online. This meticulous approach ensures you’re always getting the best possible deal.

7. Buy in Bulk for Non-Perishable Staples

- Detailed Content: For items that are always needed and don’t expire, consider buying in bulk from warehouse clubs (Costco, Sam’s Club) or online retailers. Items like pens, pencils, glue sticks, tissues, hand sanitizer, and reams of paper are often significantly cheaper per unit when purchased in larger quantities. Coordinate with other parents to split bulk packages, further maximizing savings and reducing individual outlay. Store extras properly to prevent damage or loss.

8. Explore Second-Hand and Thrift Stores

- Detailed Content: Don’t overlook the treasure trove that is second-hand shopping. Thrift stores, consignment shops, and online marketplaces (Facebook Marketplace, Poshmark, eBay) can be excellent sources for gently used clothing, uniforms (if your school has them), athletic wear, backpacks, and even some tech items like monitors or keyboards. Inspect items carefully for quality and cleanliness. This hack is not only budget-friendly but also environmentally conscious.

9. DIY and Repurpose Where Possible

- Detailed Content: Get creative! Many items can be repurposed or created at home. Old t-shirts can become cleaning rags for desks. Empty jars can be decorated to hold pens. Leftover craft supplies can be used to customize plain notebooks or binders. For younger children, simple art supplies like construction paper and crayons are often cheaper to buy separately than in pre-packaged "school kits." This teaches resourcefulness and adds a personal touch.

10. Delay Non-Essential Purchases

- Detailed Content: Resist the urge to buy everything on your child’s "want" list immediately. Some items, particularly trendy clothing or specific tech gadgets, might see price drops after the initial back-to-school rush. Additionally, your child’s actual needs might evolve once they start school and learn what their classmates have or what their teachers genuinely recommend. Prioritize the absolute essentials for the first day, and defer optional items until later in the semester or even after the holiday sales.

11. Utilize Tax-Free Shopping Holidays

- Detailed Content: Many U.S. states offer tax-free shopping holidays, typically in late July or early August, specifically for back-to-school items. During these periods, you can purchase eligible school supplies, clothing, and sometimes even computers without paying state sales tax. The savings can be substantial, especially on larger purchases. Check your state’s Department of Revenue website for specific dates, eligible items, and spending limits for 2025.

12. Look for Student Discounts and Loyalty Programs

- Detailed Content: Many retailers, especially those selling technology or apparel, offer student discounts directly. Always ask if a student discount is available, and be prepared to show a student ID. Furthermore, sign up for loyalty programs at your favorite stores. These often provide exclusive discounts, early access to sales, and points that can be redeemed for future purchases. Some credit card companies also offer bonus rewards on back-to-school categories during peak season.

13. Leverage Cashback and Rewards Programs

- Detailed Content: Maximize your spending by using cashback credit cards or shopping through cashback portals (e.g., Rakuten, Honey, TopCashback). These platforms give you a percentage of your purchase back as cash or points when you shop through their links. Pair this with a rewards credit card that offers bonus categories for department stores or online shopping during the back-to-school period for an extra layer of savings. Just ensure you pay off your credit card balance in full to avoid interest charges.

14. Pack Lunches and Snacks from Home

- Detailed Content: While not a direct back-to-school supply, daily lunch expenses can significantly impact your overall budget. Packing lunches and snacks from home is almost always cheaper and often healthier than buying cafeteria food or convenience store items. Plan meals for the week, buy ingredients in bulk, and prep items on the weekend to save time during busy weekdays. Invest in a good quality, insulated lunchbox and reusable containers for long-term savings.

15. Communicate with Teachers and the School

- Detailed Content: Before making major purchases, especially for specific supplies or technology, check with your child’s school or individual teachers. School websites often post supply lists. Sometimes, schools or parent-teacher organizations (PTOs) offer bulk purchase options for supplies at a discounted rate. Teachers might also have insights into what’s truly essential versus what’s optional, helping you refine your list and avoid unnecessary spending. Don’t be afraid to ask for clarification.

Beyond the Hacks: Long-Term Financial Habits for Families

Budgeting for back-to-school isn’t just about one season; it’s an excellent opportunity to instill broader financial literacy and build sustainable habits.

- Establish an Emergency Fund: Having a dedicated emergency fund can buffer unexpected school-related costs that pop up throughout the year.

- Teach Kids About Saving: Encourage children to save their allowance or gift money for desired back-to-school items. This helps them appreciate the value of money and the effort required to earn it.

- Review and Adjust: Your budget isn’t set in stone. Periodically review your spending and adjust your strategies based on what worked and what didn’t. This iterative process leads to continuous improvement.

- Look for Year-Round Deals: Some "back-to-school" items, like basic pens or paper, might be cheaper during other times of the year (e.g., post-holiday sales). Keep an eye out for these opportunities.

Conclusion

Budgeting for back-to-school in 2025 doesn’t have to be a source of stress. By adopting a proactive, strategic approach and implementing these 15 intelligent hacks, you can significantly reduce your expenditures, manage your finances more effectively, and ensure your children are fully equipped for a successful academic year. Remember, smart financial planning is a continuous journey, and each back-to-school season offers a fresh opportunity to refine your skills and save big. Start early, stay organized, and watch your savings grow!

Disclaimer: This article provides general financial information and budgeting strategies. Individual circumstances vary, and readers should consult with a qualified financial advisor for personalized advice. Prices and availability of products and services are subject to change.