Life is a symphony of expected and unexpected events. While we all hope for smooth sailing, the reality is that financial curveballs can strike at any moment – a sudden job loss, an unexpected medical bill, a major home repair, or an unforeseen car breakdown. Without a safety net, these events can quickly spiral into financial distress, leading to debt, stress, and a significant setback to your long-term goals.

This is where a robust family emergency fund comes into play. More than just a savings account, it’s a critical component of your financial fortress, offering peace of mind and the ability to weather life’s storms without compromising your stability. This comprehensive guide, akin to the detailed insights found on Investopedia, will walk you through every step of building an emergency fund that truly works for your family.

What is a Family Emergency Fund and Why Do You Need One?

At its core, a family emergency fund is a dedicated pool of readily accessible cash specifically set aside to cover essential living expenses and unforeseen financial crises. It is distinct from your regular savings (for a down payment, vacation, or retirement) because its sole purpose is to act as a financial shock absorber.

Why is an Emergency Fund Indispensable?

- Prevents Debt Accumulation: Without an emergency fund, unexpected expenses often lead to high-interest credit card debt, personal loans, or even dipping into retirement accounts, which can have long-term negative consequences.

- Reduces Financial Stress: Knowing you have a buffer against the unknown significantly lowers anxiety and allows you to make clear-headed decisions during a crisis, rather than panic-driven ones.

- Protects Long-Term Financial Goals: An emergency fund shields your investments and retirement savings from being prematurely liquidated, preserving their growth potential.

- Provides Financial Freedom: It empowers you to say "no" to bad options (like taking a desperate job) and gives you the flexibility to handle life on your terms.

- Builds Financial Resilience: It’s the bedrock of a strong financial plan, enabling your family to bounce back quickly from setbacks.

Common Scenarios an Emergency Fund Covers:

- Job Loss or Significant Income Reduction: Provides a bridge to cover living expenses while you search for new employment.

- Medical Emergencies: Covers high deductibles, co-pays, or unforeseen medical treatments not fully covered by insurance.

- Major Home Repairs: Furnace breakdown, roof leaks, plumbing emergencies, or appliance failures.

- Car Troubles: Significant repairs, accident deductibles, or the need for a temporary rental car.

- Unforeseen Travel: Last-minute flights for family emergencies.

- Natural Disasters: Temporary living expenses, deductibles for property damage, or immediate needs if displaced.

How Much Should Your Emergency Fund Be? The "Magic Number"

One of the most common questions is, "How much money do I need?" While there’s no universal magic number, the widely accepted benchmark for a robust emergency fund is 3 to 6 months’ worth of essential living expenses. However, for many families, a larger buffer can be more prudent.

Calculating Your Essential Monthly Expenses:

Before you can set a target, you need to understand your baseline. This isn’t about all your spending, but specifically the non-negotiable costs required to keep your family afloat.

-

List All Your Monthly Expenses: Go through your bank statements, credit card bills, and budget for the last 3-6 months.

-

Categorize as Essential vs. Discretionary:

- Essential Expenses (Non-Negotiables):

- Housing (Rent/Mortgage Payment, Property Taxes, Homeowners Insurance)

- Utilities (Electricity, Gas, Water, Sewer, Trash)

- Food (Groceries – not dining out)

- Transportation (Car Payments, Gas, Insurance, Public Transit)

- Health Insurance Premiums & Estimated Medical Costs

- Minimum Debt Payments (Student Loans, Credit Cards, Car Loans – only the minimum to avoid default)

- Childcare/Schooling (if absolutely necessary)

- Basic Communication (Cell phone, basic internet)

- Discretionary Expenses (Negotiable/Can be cut):

- Dining Out, Takeout

- Entertainment (Movies, Concerts, Subscriptions)

- Vacations/Travel

- New Clothes/Shopping

- Gym Memberships (unless medically necessary)

- Hobbies & Non-essential Memberships

- Premium Cable/Streaming Services

- Essential Expenses (Non-Negotiables):

-

Sum Your Essential Monthly Expenses: Add up all the figures from your "Essential Expenses" list. This is your baseline.

Example:

- Rent/Mortgage: $1,800

- Utilities: $300

- Groceries: $700

- Transportation (Car pymt, gas, insurance): $550

- Health Insurance: $400

- Minimum Debt Payments: $250

- Total Essential Monthly Expenses: $4,000

Determining Your Ideal Fund Size (3-6 Months… or More):

Once you have your essential monthly expenses, multiply that by your target number of months.

- Minimum Target (3 months): $4,000 x 3 = $12,000

- Standard Target (6 months): $4,000 x 6 = $24,000

Factors That May Warrant a Larger Emergency Fund (9-12+ Months):

- Single-Income Household: If one income supports the entire family, the risk of total income loss is higher.

- Unstable or Commission-Based Job: If your income fluctuates significantly or your job security is lower.

- High Deductible Health Insurance: You’ll want enough to cover your out-of-pocket maximum.

- Dependents or Special Needs: More people relying on your income, or specific medical needs, increase the financial stakes.

- Homeowners: Owning a home often comes with unexpected and costly repairs.

- Significant Debt: While you might tackle high-interest debt first, a larger fund provides more breathing room if debt payments become challenging.

- Specialized Professions: If finding a new job in your field takes a long time.

- Economic Uncertainty: During recessions or periods of high unemployment, a larger buffer is wise.

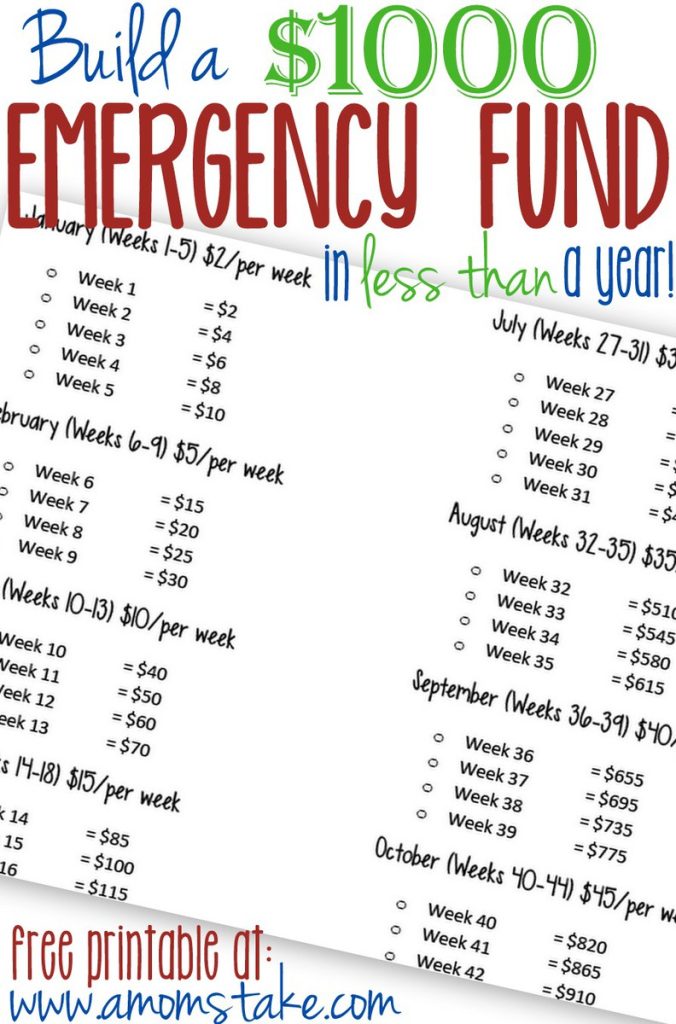

A Tiered Approach to Building:

Don’t be overwhelmed by the final number. Many financial experts recommend a tiered approach:

- Mini Emergency Fund ($1,000 – $2,500): This covers small, immediate emergencies and prevents you from going into debt while you work on the larger fund.

- Full Emergency Fund (3-6+ months of essential expenses): This is the ultimate goal.

Where Should You Keep Your Emergency Fund? (Accessibility & Safety)

The location of your emergency fund is almost as important as its size. It needs to be liquid (easily accessible) and safe (protected from market fluctuations).

Recommended Locations:

- High-Yield Savings Accounts (HYSAs):

- Pros: Offer significantly higher interest rates than traditional savings accounts (often 10-20x more), FDIC insured up to $250,000 per depositor, highly liquid (funds usually available within 1-3 business days).

- Cons: Interest rates can fluctuate with the market, may require online-only banking (less convenient for immediate cash withdrawals, but transfers are easy).

- Investopedia Insight: HYSAs are the gold standard for emergency funds because they strike the perfect balance between accessibility, safety, and modest growth.

- Money Market Accounts (MMAs):

- Pros: Similar to HYSAs in offering better interest rates than traditional savings accounts and FDIC insurance. Often come with check-writing privileges or a debit card, offering slightly more immediate access.

- Cons: May have higher minimum balance requirements than HYSAs, interest rates can still be lower than the very best HYSAs.

Less Ideal, But Potentially Acceptable (with caution):

- Certificates of Deposit (CDs) – Laddered Strategy:

- Pros: Offer a fixed, generally higher interest rate for a set term. FDIC insured.

- Cons: Funds are locked up for the CD’s term. Early withdrawal penalties can negate interest gains.

- Investopedia Insight: A CD ladder (spreading your emergency fund across CDs of varying maturity dates) can offer slightly better returns but sacrifices some liquidity. Generally, not recommended for the entire emergency fund unless you have a substantial amount.

Where You Should NOT Keep Your Emergency Fund:

- Checking Account:

- Why Not: Too easily accessible for everyday spending, making it tempting to dip into for non-emergencies. Offers virtually no interest.

- Stock Market (Stocks, Mutual Funds, ETFs):

- Why Not: Highly volatile. You could need the money when the market is down, forcing you to sell at a loss. Not liquid enough for immediate needs.

- Cryptocurrency:

- Why Not: Extreme volatility, lack of regulatory protection (in many cases), and complex accessibility. Absolutely not suitable for emergency funds.

- Physical Cash (Large Amounts):

- Why Not: Risk of loss, theft, or damage. Not FDIC insured. While a small amount for very immediate needs is okay, the bulk should be in a bank.

- Home Equity or Retirement Accounts (401k, IRA):

- Why Not: Borrowing from home equity (HELOC) or withdrawing from retirement accounts often incurs penalties, taxes, and interest, defeating the purpose of an emergency fund. These are last resorts.

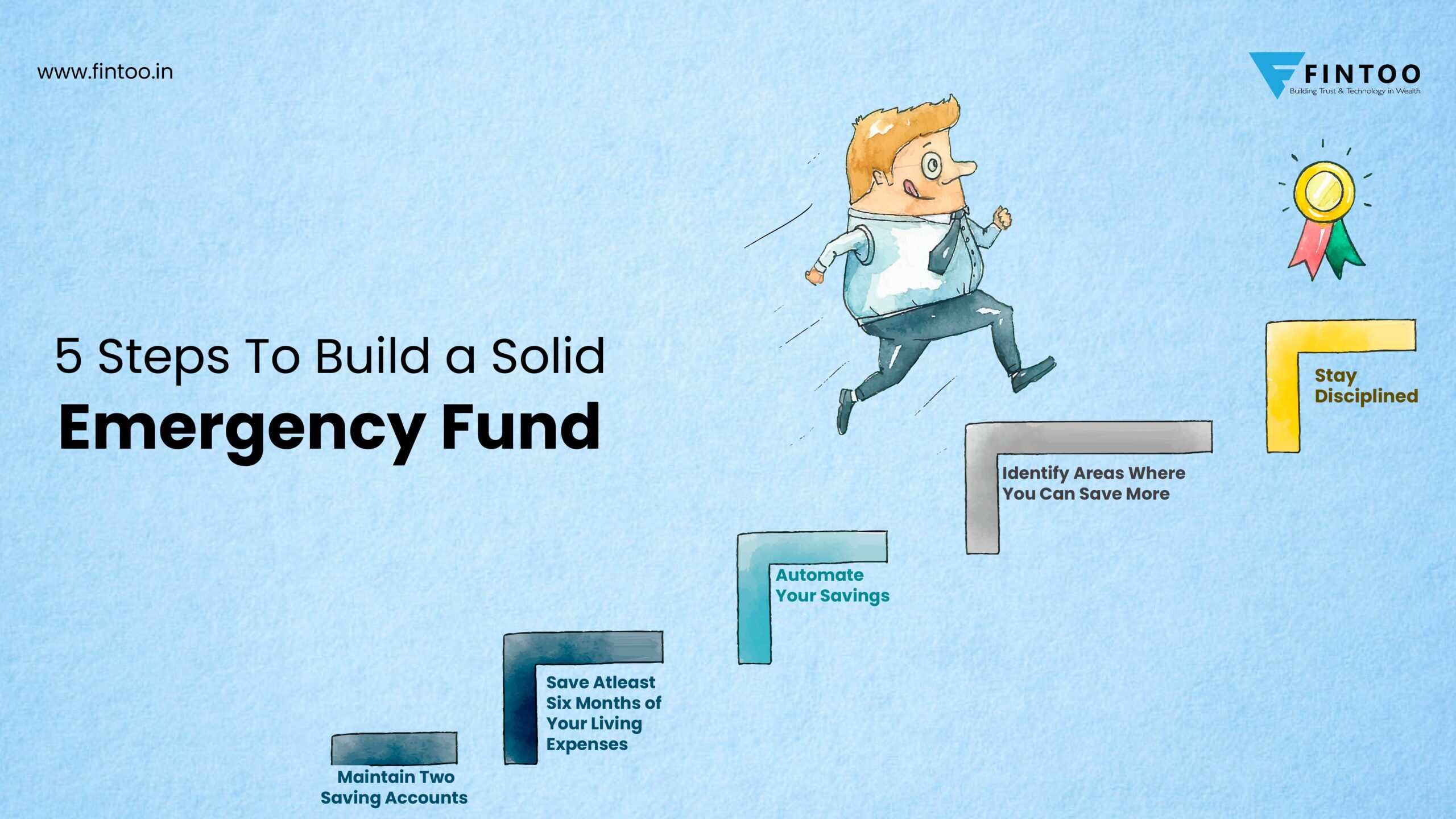

The Step-by-Step Guide to Building Your Emergency Fund

Building a substantial emergency fund requires discipline, a clear plan, and consistent action. Here’s a detailed roadmap:

Step 1: Calculate Your Essential Monthly Expenses (Revisit & Refine)

As detailed above, this is your foundational step. Be honest and thorough. Use a spreadsheet or a budgeting app to track every dollar for a few months. Identify where your money truly goes. This isn’t just a number; it’s your target.

- Action: Create a detailed list of essential monthly expenses.

- Outcome: A clear "survival number" for your family per month.

Step 2: Set a Clear Target Goal

Based on your essential monthly expenses and your family’s unique circumstances (job stability, number of dependents, health), determine if you’re aiming for 3, 6, 9, or 12+ months. Write this number down. This gives you something concrete to work towards.

- Action: Decide on your total emergency fund goal (e.g., $24,000 for 6 months).

- Outcome: A motivating, measurable financial objective.

Step 3: Create a Budget (or Optimize Your Existing One)

This is where you find the money to fund your emergency savings. A budget is simply a plan for your money.

- Track Your Spending: For at least a month, record every dollar you spend. This reveals spending patterns and "leaks."

- Identify Areas to Cut: Look for discretionary expenses you can reduce or eliminate temporarily.

- Can you cut back on dining out?

- Are there subscriptions you don’t use?

- Can you carpool or use public transport more often?

- Can you find cheaper insurance rates?

- Can you trim your grocery bill by meal planning?

- The "Zero-Based Budget" Approach: Assign every dollar a job. If it’s not going to an expense, it’s going to savings.

- Action: Develop a realistic budget that prioritizes saving for your emergency fund.

- Outcome: Identified "extra" money that can be directed to savings.

Step 4: Automate Your Savings (The Golden Rule)

This is arguably the most critical step. "Set it and forget it" is powerful for building an emergency fund.

- Set Up Automatic Transfers: Schedule a recurring transfer from your checking account to your high-yield emergency fund savings account on payday.

- Treat It Like a Bill: Just as you pay your rent or mortgage, make your emergency fund contribution a non-negotiable expense.

- Start Small, Grow Big: Even if you can only afford $50 or $100 per paycheck initially, start somewhere. As your budget improves, increase the amount.

- Action: Schedule an automatic transfer to your emergency fund account immediately after each paycheck.

- Outcome: Consistent, effortless progress towards your goal.

Step 5: Boost Your Income (If Necessary)

If your budget cuts aren’t enough, or you want to accelerate your progress, consider increasing your income.

- Side Hustles: Freelancing, ride-sharing, food delivery, dog walking, online tutoring, selling crafts, or virtual assistant work.

- Sell Unused Items: Declutter your home and sell clothes, electronics, furniture, or collectibles on platforms like eBay, Facebook Marketplace, or local consignment shops.

- Ask for a Raise: If you’ve been a valuable employee and haven’t had a raise recently, prepare your case and ask.

- Overtime: If available at your current job, volunteer for extra hours.

- Action: Explore options to generate additional income specifically for your emergency fund.

- Outcome: Faster accumulation of your emergency savings.

Step 6: Treat It Like a Bill (Prioritization)

Make your emergency fund a priority, not an afterthought. When money comes in, a portion should immediately go to this fund before you spend on anything else. This is often called "paying yourself first."

- Action: Prioritize your emergency fund contribution above discretionary spending.

- Outcome: A consistent and growing fund.

Step 7: Prioritize Debt Repayment (Strategically)

This step often causes confusion. Here’s the recommended approach:

- Build a Mini Emergency Fund ($1,000 – $2,500): This initial buffer protects you from new debt while you tackle existing high-interest debt.

- Aggressively Pay Down High-Interest Debt: Focus all extra money (beyond essential expenses and your mini-fund contribution) on credit cards, payday loans, or other debt with interest rates typically above 8-10%. The interest you save often outweighs the interest you’d earn on savings.

- Resume Full Emergency Fund Building: Once high-interest debt is eliminated, redirect all that freed-up cash flow to rapidly build your full 3-6+ month emergency fund.

- Action: Follow a strategic plan for debt repayment alongside emergency fund building.

- Outcome: Reduced financial burden and a fully funded emergency safety net.

Maintaining and Replenishing Your Emergency Fund

Building the fund is a huge accomplishment, but it’s not a "set it and forget it" situation forever.

When to Use Your Emergency Fund: True Emergencies Only

Resist the temptation to dip into your fund for non-emergencies. Remember the list of scenarios it’s designed for. That new TV, a vacation, or concert tickets are not emergencies. If it’s not urgent, essential, and unexpected, it’s not an emergency fund expense.

Replenishing Your Fund: The Non-Negotiable Step

If you do need to use your emergency fund, your immediate next financial priority (after handling the emergency itself) is to replenish it. Treat it with the same urgency as building it the first time. Re-establish your automatic transfers and consider temporarily increasing contributions until it’s back to your target level.

Regular Review and Adjustment: Life Changes

Your financial situation and essential expenses aren’t static. Review your emergency fund at least once a year, or whenever major life events occur:

- Job Change: A new salary, new job security level.

- Marriage/Children: New dependents, increased expenses.

- Home Purchase: New responsibilities, potential for larger repairs.

- Health Changes: New medical needs, different insurance.

- Economic Shifts: Inflation might increase your essential expenses.

Adjust your target amount and contributions as needed to ensure your fund remains adequate.

Common Pitfalls to Avoid

- Using It for Non-Emergencies: The biggest trap. Your emergency fund is not for impulse buys or discretionary spending.

- Keeping It in a Checking Account: Too easy to spend, too low interest.

- Not Having One At All: The most dangerous pitfall, leaving your family vulnerable.

- Underestimating Expenses: Be realistic when calculating your essential costs. Don’t forget insurance premiums, minimum debt payments, or infrequent but essential costs (like annual car registration).

- Giving Up Too Soon: Building an emergency fund can take time. Celebrate small victories and stay consistent.

- Ignoring Inflation: Over time, your dollar buys less. Regularly review and potentially increase your fund to maintain its real value.

Conclusion: Your Family’s Foundation of Financial Security

Building a family emergency fund that works is one of the most impactful financial decisions you can make. It’s an act of self-care, family protection, and strategic financial planning. While the journey requires discipline and patience, the peace of mind and resilience it provides are invaluable.

By understanding its purpose, calculating your needs, choosing the right location, and consistently applying a disciplined savings strategy, you can construct a financial safety net that empowers your family to navigate life’s inevitable challenges with confidence and stability. Start today – even small steps lead to significant results, securing your family’s future, one dollar at a time.