Parenthood is a journey filled with immeasurable joy, profound love, and countless cherished moments. It’s also an undertaking with significant financial implications. For prospective and new parents in the United States, understanding the true cost of raising a child – from infancy through adulthood – is not just prudent; it’s essential for building a stable future.

This comprehensive guide, inspired by the depth and detail of financial resources like Investopedia, will break down the various expenses associated with raising a child in the U.S., explore the often-overlooked "hidden" costs, and provide actionable strategies to prepare financially for this monumental life change.

The Staggering Numbers: Understanding the Baseline

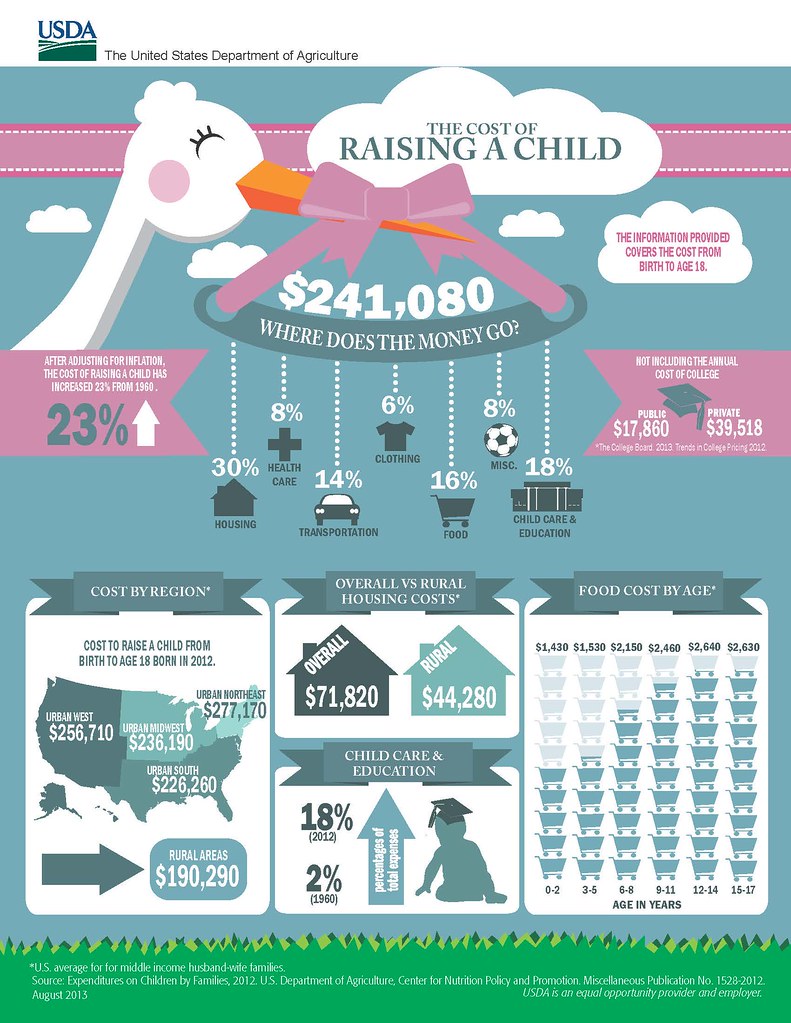

For decades, the U.S. Department of Agriculture (USDA) provided a widely cited estimate for the cost of raising a child. While the USDA discontinued its report in 2015, institutions like the Brookings Institute and various financial organizations have continued to provide updated figures.

Recent estimates suggest that the average cost of raising a child from birth through age 17 in the U.S. can range from approximately $300,000 to over $310,000 for a middle-income family. This figure, however, excludes the substantial cost of college education and the potential loss of parental income. When factoring in college and other variables, some projections push this number closer to $500,000 or even higher.

It’s crucial to understand that these are national averages. Individual costs can vary dramatically based on:

- Geographic Location: Urban areas and coastal states typically have much higher costs of living, especially for housing and childcare.

- Family Income Level: Higher-income families tend to spend more on discretionary items, private education, and extracurricular activities.

- Number of Children: While some costs can be shared, each additional child adds significant expenses.

- Parental Choices: Decisions like private vs. public schooling, organic food choices, and extensive extracurriculars all impact the bottom line.

Deconstructing the Costs: Where Does the Money Go?

Let’s break down the major categories of expenses that contribute to the overall cost of raising a child.

1. Housing (The Largest Share)

While not a direct "child-specific" expense, having children often necessitates a larger living space, leading to increased housing costs. This can include:

- Larger Home: Moving to a bigger house or apartment to accommodate a growing family.

- Increased Rent/Mortgage: Higher payments for more square footage.

- Utilities: More people generally mean higher utility bills (electricity, water, heating/cooling).

- Maintenance & Repairs: More wear and tear on the home, potentially leading to increased maintenance costs.

- Property Taxes & Insurance: These often increase with larger or more expensive homes.

Impact: Housing typically accounts for 29-33% of total child-rearing expenses, making it the largest single category.

2. Childcare (A Major Budget Strain)

For working parents, childcare is often the most significant and immediate financial shock. Costs vary wildly by state, type of care, and age of the child.

- Infant Care: Generally the most expensive due to higher caregiver-to-child ratios.

- Daycare Centers: Costs can range from $9,000 to over $20,000 per year, with some states like Massachusetts and New York exceeding $25,000 annually.

- Nannies/In-Home Care: While offering flexibility and personalized attention, this option is typically the most expensive, often ranging from $30,000 to $70,000+ per year, depending on location and duties.

- Family Care: While often more affordable, care from relatives or friends can still involve significant expenses if they are compensated, or lead to indirect costs.

- After-School Programs: For older children, these programs can add several thousand dollars per year.

Impact: Childcare can easily consume 10-20% of a family’s income, and for many, it rivals or even surpasses housing costs.

3. Food (From Formula to Teen Appetites)

Feeding a growing child is a continuous and evolving expense.

- Infant Stage:

- Formula: Can cost $1,200 to $1,500+ per year for the first year alone.

- Solid Foods: Purees, baby cereals, and snacks add to the grocery bill.

- Toddler & Childhood: Increasing portions, a wider variety of foods, and potentially picky eating habits.

- Teenage Years: Famously high appetites, often leading to significantly higher grocery bills.

- Special Dietary Needs: Allergies or specific health requirements can increase food costs.

- School Lunches & Snacks: Whether packed or purchased, these are ongoing expenses.

Impact: Food typically accounts for 15-18% of child-rearing expenses.

4. Healthcare (Beyond the Basics)

Even with good insurance, healthcare costs for children can add up quickly.

- Insurance Premiums: Adding a child to a family health insurance plan will increase monthly premiums.

- Co-pays & Deductibles: Frequent doctor visits (especially in infancy), urgent care, and specialist appointments contribute to out-of-pocket costs.

- Prescription Medications: For common illnesses or chronic conditions.

- Dental Care: Regular check-ups, cleanings, and potential orthodontic work later on.

- Vision Care: Eye exams and glasses, if needed.

- Unexpected Illnesses/Injuries: Emergency room visits, hospital stays, and therapies can be very expensive.

Impact: Healthcare typically accounts for 8-10% of child-rearing expenses, but can spike dramatically with unforeseen medical needs.

5. Education (Beyond College)

While college is a separate beast, K-12 education still carries costs.

- Preschool/Pre-K: If not covered by public programs, these can be expensive, similar to childcare.

- School Supplies: Backpacks, notebooks, pens, art supplies, and classroom fees.

- Extracurricular Activities: Sports leagues, music lessons, dance classes, tutoring, summer camps – these can easily run into thousands of dollars annually per child.

- Private School Tuition: A major expense, often ranging from $10,000 to $50,000+ per year, depending on the institution and location.

- Technology: Laptops, tablets, and internet access for homework and learning.

Impact: Education (excluding college) can vary widely, but for families opting for private school or extensive activities, it can be one of the largest budget items.

6. Clothing, Diapers & Other Essentials

The constant need for new items as children grow.

- Diapers: For infants and toddlers, diapers and wipes are a consistent expense, potentially costing $70-100+ per month.

- Clothing: Children outgrow clothes rapidly, requiring frequent purchases. Seasonal changes and special occasions add to the cost.

- Baby Gear: Cribs, strollers, car seats (which expire and need replacement), high chairs, changing tables – these are significant upfront costs.

- Toys & Books: While some can be hand-me-downs or borrowed, children often desire new items.

- Personal Care Items: Lotions, shampoos, sunscreen, hair products.

Impact: This category typically accounts for 6-8% of child-rearing expenses.

7. Transportation

Having children often impacts transportation needs and costs.

- Larger Vehicle: The need for a minivan or SUV to accommodate car seats, strollers, and gear.

- Fuel & Maintenance: More driving for school, activities, doctor appointments, and family outings.

- Car Seats: Multiple car seats are needed as children grow, and these are safety-critical purchases.

- Public Transportation: Fares for older children.

Impact: Transportation typically accounts for 13-15% of child-rearing expenses.

8. Miscellaneous & Discretionary

This catch-all category includes a range of expenses that are harder to categorize but are very real.

- Entertainment: Family outings, movies, amusement parks, vacations.

- Gifts: Birthday and holiday gifts for the child and for other children’s parties.

- Haircuts & Personal Services:

- Allowances: For older children.

- Hobbies & Interests: Specialized equipment for sports, musical instruments.

- Furniture: Beds, dressers, desks as they grow.

- Technology: Cell phones, gaming consoles.

Impact: This category can vary wildly based on family lifestyle and budget.

The Hidden & Overlooked Costs of Parenthood

Beyond the direct expenditures, there are several less obvious but equally significant financial impacts of raising a child.

- Lost Parental Income & Opportunity Cost:

- Stay-at-Home Parent: One parent may reduce work hours or leave the workforce entirely, resulting in a significant loss of income, retirement contributions, and career progression.

- Reduced Hours/Flexible Work: Even if both parents work, one might take a less demanding role or work part-time, impacting earnings.

- Career Advancement: Taking time off or reducing hours can slow promotions and salary increases for years.

- Social Security Benefits: Lower lifetime earnings can result in reduced Social Security benefits in retirement.

- Increased Insurance Premiums:

- Life Insurance: The need for robust life insurance policies for both parents to protect the family in case of an unforeseen death.

- Disability Insurance: Crucial to replace income if a parent becomes unable to work.

- Homeowners/Renters Insurance: May increase with more valuable belongings or potential liability.

- Estate Planning Costs: Setting up wills, trusts, and guardianship documents to ensure children are cared for if something happens to both parents.

- Emotional & Time Costs: While not strictly financial, the emotional labor, stress, and time commitment required for parenting can impact productivity, health, and ultimately, earning potential.

- Higher Utility Bills: More people, more laundry, more lights on, more showers – all contribute to higher household expenses.

- Increased Travel Costs: Airfares, accommodation, and activities for children can add significantly to family vacation budgets.

Beyond K-12: The College Quandary

The estimates of $300,000 to $310,000 for raising a child typically stop at age 17. The cost of a college education is a separate, monumental expense that many parents choose to shoulder, at least in part.

- Average College Costs: For the 2023-2024 academic year, the average annual cost (tuition, fees, room, and board) for a four-year in-state public university was over $28,000, while out-of-state public universities averaged over $45,000. Private universities averaged over $60,000 per year.

- Total College Cost: Over four years, this can easily amount to $112,000 to $240,000 per child, or more, depending on the institution and financial aid received.

Factoring in college education, the total cost of raising a child from birth through a bachelor’s degree can realistically approach or exceed half a million dollars.

How to Prepare: A Financial Blueprint for Parents

While the numbers can seem daunting, effective financial planning can make the cost of raising a child manageable. Here’s how to prepare:

1. Create a Detailed "Baby Budget" (Pre- and Post-Arrival)

- Before Conception/Pregnancy: Start tracking your current expenses to understand your baseline. Identify areas where you can cut back to save for baby-related costs.

- During Pregnancy: Budget for one-time costs like baby gear (crib, stroller, car seat) and recurring expenses like diapers, formula, and increased utilities.

- Post-Arrival Adjustment: After the baby arrives, track actual expenses for a few months. Your initial budget will likely need adjustments as you learn your child’s specific needs and your family’s new rhythm.

- Tools: Utilize budgeting apps (You Need A Budget, Mint, Personal Capital), spreadsheets, or even pen and paper to monitor income and outflows.

2. Bolster Your Emergency Fund

- Increased Buffer: A standard emergency fund covers 3-6 months of living expenses. With a child, consider increasing this to 6-9 months, or even a year, especially if one parent plans to take time off or work part-time.

- Unexpected Costs: Children bring unforeseen medical bills, home repairs, or job changes, making a robust emergency fund critical.

3. Review and Update Your Insurance Coverage

- Health Insurance: Understand your employer’s plan for adding a dependent. Compare costs, deductibles, and co-pays. Consider a Flexible Spending Account (FSA) or Health Savings Account (HSA) for tax-advantaged healthcare savings.

- Life Insurance: Both parents should have adequate term life insurance policies. A common guideline is 5-10 times your annual salary to cover income replacement, debts, and future expenses like college.

- Disability Insurance: Protect your income if you become unable to work due to illness or injury. Many employers offer basic coverage, but supplemental policies may be necessary.

- Homeowners/Renters Insurance: Review liability limits and consider increasing them.

4. Establish a College Savings Plan Early

- 529 Plans: These state-sponsored plans offer tax advantages, including tax-free growth and withdrawals for qualified education expenses. They are generally considered the best option for college savings.

- Coverdell ESAs: Another tax-advantaged option, but with lower contribution limits and income restrictions.

- Custodial Accounts (UGMA/UTMA): While not specific to education, these accounts allow you to save money in a child’s name, but assets are controlled by the child at the age of majority and can impact financial aid eligibility.

- Start Small: Even contributing a small amount regularly can add up significantly over 18 years due to compound interest.

5. Prioritize Estate Planning

- Will: Designate guardians for your children in your will. This is perhaps the most crucial step for parents.

- Trusts: Consider setting up a trust to manage assets for your children if you pass away, especially if they are minors.

- Power of Attorney: Appoint someone to make financial and healthcare decisions on your behalf if you become incapacitated.

6. Maximize Tax Benefits

- Child Tax Credit (CTC): A significant credit for eligible families, potentially reducing your tax liability dollar-for-dollar.

- Child and Dependent Care Credit: Helps offset the cost of childcare for working parents.

- Earned Income Tax Credit (EITC): For low-to-moderate income families, this credit can be substantial.

- Dependent Care FSA: Allows you to set aside pre-tax money for eligible childcare expenses.

7. Embrace Smart Spending and Frugality

- Second-Hand Items: Buy gently used baby clothes, gear (cribs, changing tables – ensure car seats are new for safety), and toys. Online marketplaces, consignment shops, and local parent groups are great resources.

- Borrow/Rent: Consider borrowing baby gear or renting specialized equipment for short-term needs.

- Meal Planning: Plan meals to reduce food waste and save on groceries. Cook in bulk.

- DIY & Creativity: Make your own baby food, create homemade gifts, or find free/low-cost activities.

- Leverage Sales & Coupons: Stock up on diapers, wipes, and other non-perishable essentials when they are on sale.

- Government Programs & Subsidies: Explore programs like SNAP (food assistance), WIC (nutrition for women, infants, and children), or state-specific childcare subsidies if eligible.

8. Review Career and Income Strategies

- Parental Leave Policies: Understand your employer’s maternity/paternity leave and short-term disability benefits.

- Flexible Work Arrangements: Discuss options like remote work, compressed workweeks, or flexible hours with your employer.

- Income Enhancement: Consider opportunities for professional development, side hustles, or a career change that offers better work-life balance or higher earning potential.

- Stay-at-Home vs. Childcare Cost Analysis: If one parent considers staying home, calculate the net financial impact. Factor in not just lost income but also savings on childcare, transportation, professional clothing, and increased tax benefits.

The ROI of Parenthood: More Than Just Money

While this article focuses on the financial realities, it’s crucial to remember that the return on investment (ROI) of parenthood is immeasurable. The love, joy, personal growth, and unique bond with your child far outweigh any monetary cost.

Financial preparedness doesn’t diminish the experience; it enhances it. By understanding and planning for the real costs, parents can reduce stress, make informed decisions, and focus on what truly matters: nurturing their children and building a loving, stable family environment.

Conclusion

Raising a child in the U.S. is a significant financial commitment, spanning decades and encompassing a wide array of expenses from housing and childcare to education and unexpected costs. By taking a proactive, detailed, and strategic approach to financial planning, prospective and new parents can navigate these costs with confidence. Start early, budget wisely, maximize your savings and tax benefits, and protect your family with appropriate insurance and estate planning. The journey of parenthood is a marathon, not a sprint, and financial preparedness is your essential training.

Disclaimer: This article is intended for informational purposes only and does not constitute financial, tax, or legal advice. Always consult with a qualified financial advisor, tax professional, or attorney for advice tailored to your specific situation.